59016

The following diagnostic is generating:

Partnership # {PrefixNum} : The program does not automatically reduce Qualified Business Income (QBI) by unreimbursed partnership expenses. Enter the correct QBI as an override.

Solution:

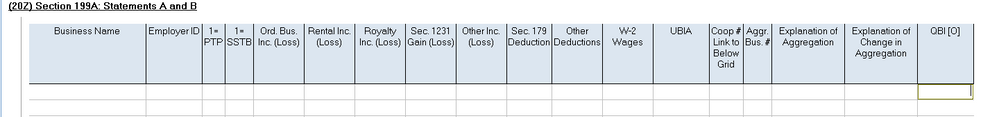

This diagnostic generates in 2022 Lacerte Tax (or prior) when a partnership K-1 is entered that has both Qualified Business Income (Form 1040 Line 13) and unreimbursed expenses. In 2023 Lacerte tax (or later) an input column for Unreimbursed Expenses was added to the QBI section of the partnership K-1 input. 2023 Lacerte tax (or later) does have the ability to reduce QBI by unreimbursed expenses, so this diagnostic no longer generates. 1) Go into Screen 20.1, Partnership K-1. 2) Select that specific entity in the partnership list on the left. 3) Scroll to the section "Line 20, 21 - Other". 4) Select the relevant entity's line in the field "(20Z) Section 199A: Statements A and B" 5) Make an entry in the "QBI [O]" column with the corrected QBI amount. This will force Lacerte to use the overridden QBI amount for this activity and will clear the diagnostic.

Comments

09-30-2023

04:28 PM

- Mark as Read

- Mark as New

- Bookmark

- Permalink

- Report Inappropriate Content

09-30-2023

04:28 PM

See QBI [O] Screen 20, Code 1158 which is found in the 20Z Section 199A area)

On my small monitor I have to move the slider all the way to the right.

See the snip.

For the last question: I don't know of a worksheet specifically for modified QBI. But I think you can reconcile it on the K-1 Rec worksheets.

10-12-2023

12:10 PM

- Mark as Read

- Mark as New

- Bookmark

- Permalink

- Report Inappropriate Content

10-12-2023

12:10 PM

I entered the override in the QBI(O) column and the diagnostic is still there.