Flexible eSignature Knowledge-Based Authentication (KBA) individual returns in ProSeries

by Intuit•1• Updated about 32 minutes ago

What is Flexible eSignature Authentication?

Flexible Authentication is when we have determined whether a taxpayer is a returning taxpayer for the accountant and then give the accountant the option to send the eSignature request with or without the Knowledge-Based Authentication (KBA) method.

How does the ProSeries program determine if the taxpayer is a returning client for the accountant?

Returns created in a different edition of ProSeries in the prior year would not be considered a returning taxpayer for this purpose. Ex: If the return was prepared in ProSeries Basic in the prior year, but ProSeries Professional in the current year.

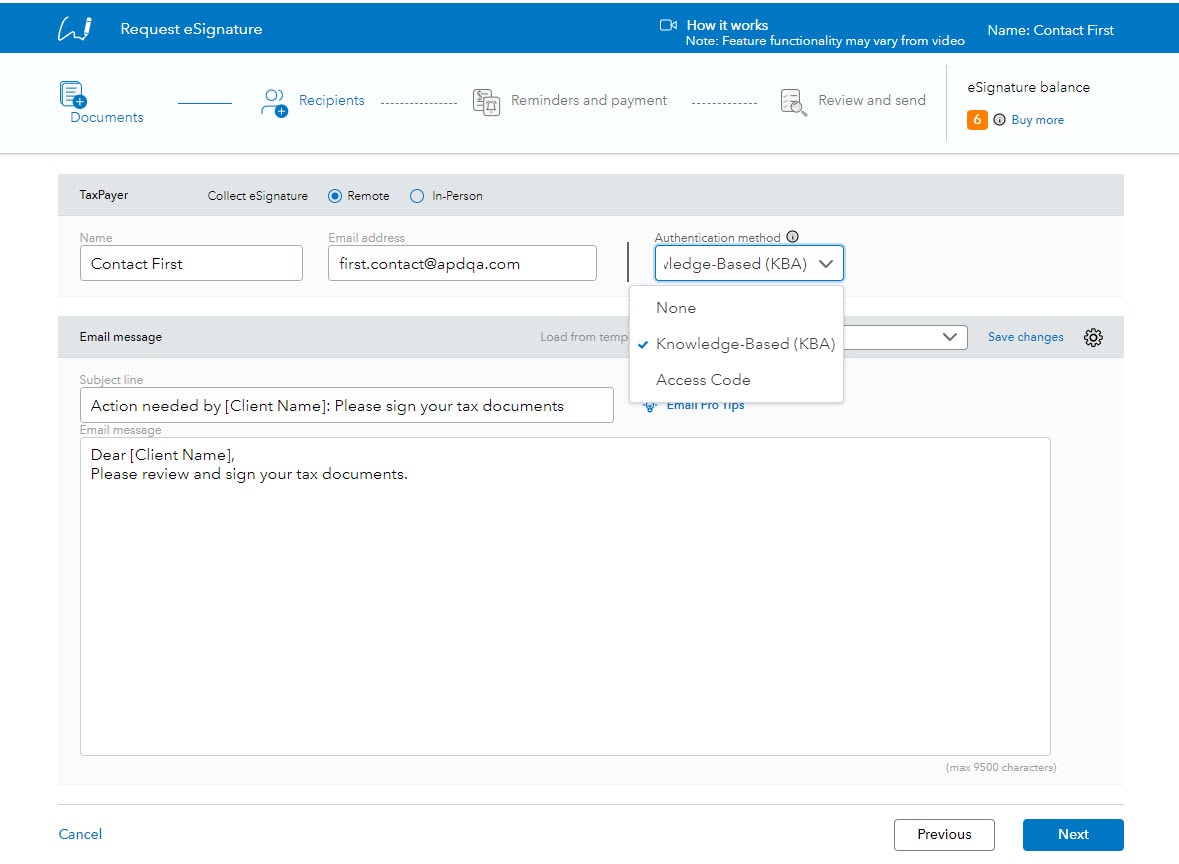

When the eSignature Request wizard is started, the program will check back-end e-filing system for the CAN and primary taxpayers SSN. If an Accepted prior year return is found, the Authentication Method drop-down selection will be active in the current year ProSeries program so accountants can set the desired authentication method. The accountant can select None (No authentication method), Knowledge-Based KBA (KBA Authentication method), or Access Code.

If an Accepted prior year tax return is NOT found for the taxpayer and CAN, the authentication method selection will default to Knowledge-Based Authentication (KBA) and drop-down menu will be disabled. The eSignature request can still be sent to the taxpayer but the KBA authentication will be enforced for this return.