53656

The following diagnostic is generating:

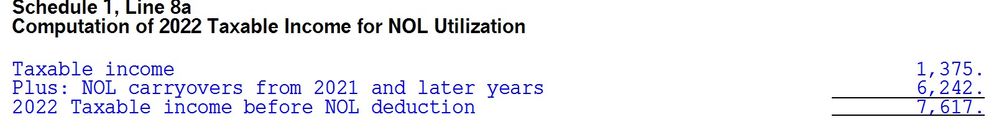

NOL # {PrefixNum} : The program doesn't automate the limitation of post-2017 net operating losses to 80% of taxable income, before taking into account any NOL deduction. You must override the amount of post-2017 NOL carryforward absorbed this year so it does not exceed the 80% of taxable income limit. If the net operating loss comes from an estate or trust Schedule K-1, enter the amount absorbed in that screen.

Solution:

- Mark as Read

- Mark as New

- Bookmark

- Permalink

- Report Inappropriate Content

From the IRS Pub 536: "...(b) 80% of the excess (if any) of taxable income computed without regard to deductions for NOLs, or Qualified Business Income (QBI), or section 250 deductions, over the...

The statement produced by LC does not back out the QBID.

Unless I am missing something, the LC statement is wrong.

- « Previous

- Next »